In Canada, filing an income tax return is not required if you don’t owe tax unless you are specifically asked to file by the Canada Revenue Agency (CRA). However, many means-tested programs are based on data from the return, so it is often advantageous to file whether you need to or not.

Have you filed your tax return yet?

I hope so. The deadline for most people to file their tax return was the end of April. Fun fact: self-employed business owners have until mid-June to file, but if they owe money they must pay it before the end of April. That’s right. Business owners are required to pay what they owe months before they know how much they owe, so effectively they still need to file by April. Only a government could make up a rule like that.

Do you owe money or are you getting some back?

From February 9 to May 8, 2023, per the canada.ca website (1), 26,172,049 returns had been filed with over 4.5 million of those being nil returns. Of the remaining returns, I found a couple things interesting:

• Nearly 6 million returns owed an average of $6,896

• The majority (over 15 million) received a refund averaging $2,117

Most people like to get money back and most people did. But have you considered that when you get money back, that means you gave the CRA an interest-free loan for the year? If you regularly get money back (perhaps due to significant charitable gifts or regular RRSP contributions), consider reducing how much is held back at the source, if you can.

Sometimes this is as simple as a quick call requesting a lower withholding tax on pension payments. If you’re employed, filling out a T1213 Request to Reduce Tax Deductions at Source is the way to go, but start early! Be aware that the CRA has been backed up for over a year (but probably more now due to their recent strike) and getting approval can take many more months than the two or three that they recommend. The last such request we made took over five months!

On the flip side, be wary of owing too much. If your tax owing is over $3,000 and that was also the case in either 2022 or 2021, you will get a tax instalment notice requesting that you pay quarterly instalments. And those are a pain. While you are only required to comply with this request if you expect to owe taxes in the upcoming year, failing to comply and subsequently owing taxes will result in interest charges for the missed payments.

If you are getting a refund, what are you doing with it?

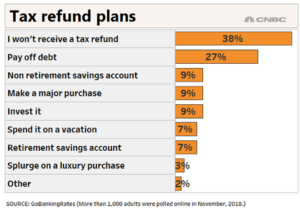

There aren’t a lot of statistics on what people do with their returns. A November 2018 GoBankingRates poll (2) of more than 1,000 Americans asked about their tax refund plans.

With interest rates rising, paying off debt (especially if it’s credit card debt) can be a very smart move. Think of it like this: paying down a debt with 9% interest is like earning a guaranteed 9% after tax.

Alternatively, if there is room in a tax-free savings account (TFSA) for that refund, awesome! That also creates tax-free returns. Investment markets were poor last year suggesting that they will do well in the next few years.

Or, if you are in a high tax bracket, investing in a registered retirement savings plan (RRSP) could yield spectacular results. For example, if you are in a 53.50% marginal tax bracket and have just received a $5,000 return, consider making a $10,750 RRSP contribution. A 53.50% tax savings on $10,750 is a whopping $5,751.25, netting down the cost of that contribution to $4,998.75, so you’ll even have $1.25 to spare. And if you use the aforementioned T1213 form, you can reduce the tax withheld from your income right now. So, rather than having to wait until April to get the return, you get an increased paycheque between now and the end of the year.

Of course, if you have everything squared away, your retirement plans are all on track, and you have no urgent need for the funds, blowing the money on something frivolous is always an option. I hear that Richard Branson, Jeff Bezos, or Elon Musk will gladly send you into space for as little as $250,000. A bargain when you consider Dennis Tito (the world’s first space tourist) paid a cool $20 million back in 2001.

Whatever your situation, I highly encourage you to file your return even if you aren’t required to. It may yield benefits you didn’t know were available. And if you get money back, look at your options, consider what’s right for you, and make it happen.

“Trust in the Lord with all your heart and lean not on your own understanding;

in all your ways submit to him, and he will make your paths straight.”

– Solomon

Sources:

Individual income tax return statistics for the 2023 tax-filing season: https://www.canada.ca/en/revenue-agency/corporate/about-canada-revenue-agency-cra/individual-income-tax-return-statistics.html

Here’s what American do with their tax refunds: https://www.cnbc.com/2019/03/01/heres-what-americans-will-do-with-their-tax-refunds.html

Arnold Machel, CFP® lives, works, and worships in the White Rock/South Surrey area. He is a Certified Financial Planner with IPC Investment Corporation and Visionvest Financial Planning & Services. In 2022 he was named as one of BCs Top Wealth Advisors by The Globe & Mail. Visionvest (his firm) has been voted Best Investment/Financial Advisor by Peace Arch News readers for the past two years in a row.

Questions and comments can be directed to him at dr.rrsp@visionvest.ca or through his website at www.visionvest.ca. Please note that all comments are of a general nature and should not be relied upon as individual advice. The views and opinions expressed in this commentary may not necessarily reflect those of IPC Investment Corporation. While every attempt is made to ensure accuracy, facts and figures are not guaranteed.

Leave a Reply